[ad_1]

“Continuing on this journey of digitalisation of banking services, last year we launched the pilot of a technology platform which enables frictionless credit.From now on, we propose to call it the ULI. Based on our experience from the pilot project, a nationwide launch of the ULI will be done in due course,” said Das.

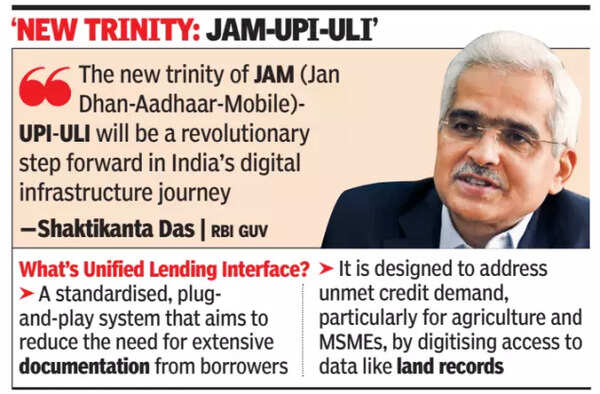

ULI enables seamless, consent-based digital information flow, including land records from various sources to lenders, speeding up credit appraisal for small businesses and rural borrowers. Its standardised, plug-and-play APIs simplify integration, reducing the need for extensive documentation. ULI addresses unmet credit demand, particularly for agriculture and MSMEs, by digitising access to financial and non-financial data.

“The ‘new trinity’ of JAM-UPI-ULI will be a revolutionary step forward in India’s digital infrastructure journey,” Das added.

Speaking at a global conference on digital public infrastructure in Bengaluru, Das said the programmability feature of the central bank digital currency would enable last-mile inclusion. “It is important to emphasise that there should not be any rush to roll out system-wide CBDC before one acquires a comprehensive understanding of its impact on users, on monetary policy, on the financial system and on the economy.”

On cross-border payments where UPI is beginning to play a role, Das said that India is happy to develop a plug-and-play system to enable interoperable cross-border payments. However, there would be a challenge as countries would want to develop their own systems. “We can overcome this challenge by developing a plug-and-play system which allows replicability while also maintaining the sovereignty of respective countries. India has made some progress in this direction and would be happy to develop a plug-and-play system for the benefit of the community of nations,” said Das.

The governor said that he expected all regulated entities to leverage AI but with caution. “Integrating this cutting-edge technology into a robust and responsible DPI presents an opportunity to amplify the capabilities and efficiency of DPI even further… However, such advancements come with serious challenges,” he said. “AI is a data-driven science. The authenticity of data being used in training the models, possibility of biases, concerns of data privacy need to be carefully examined,” he added.

Besides the mushrooming of digital lenders, there has been several public infrastructure developments in straight-through lending.

[ad_2]

Source link