[ad_1]

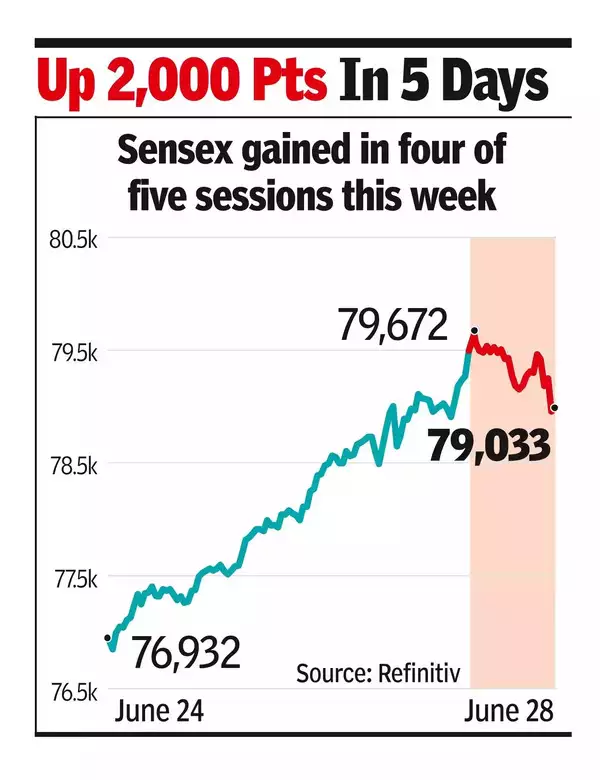

The sensex declined 210 points to close at 79,033 after hitting a new high of 79,672 in the first half. Meanwhile, Nifty – after touching a new life-high of 24,174 during the day – ended 34 points lower at 24,010.

Despite the selling pressure, the sensex and Nifty closed above the psychological levels of 79,000 and 24,000, thanks to a strong rally in Reliance Industries. Shares of Reliance rose 2.2% to a record high on Friday after its telecom arm revised its tariff.

“Profit-taking in banking stocks led the downfall in key benchmark indices, which had hit fresh intra-day highs in early optimism,” said Prashanth Tapse, senior VP (research), Mehta Equities. “Renewed FII buying in the current month so far and Indian govt bonds’ inclusion in JP Morgan EM bond index had triggered a major rally this week, but markets could turn volatile once again as higher valuations and no change in interest rate stance could prompt investors to book profit at regular intervals,” he added.

The recovery in Indian markets in June is attributed to foreign portfolio investors, who have bought $2.3 billion of shares in the month, ending a two-month selling streak. The sensex’s top losers were IndusInd Bank (2.6%), Axis Bank (1.8%), Bharti Airtel (1.8%), ICICI Bank (1.6%) and Kotak Bank (1.5%). The gainers besides Reliance were Tata Motors (1.8%), Asian Paints (1.2%) and Nestle (0.8%).

[ad_2]

Source link